See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

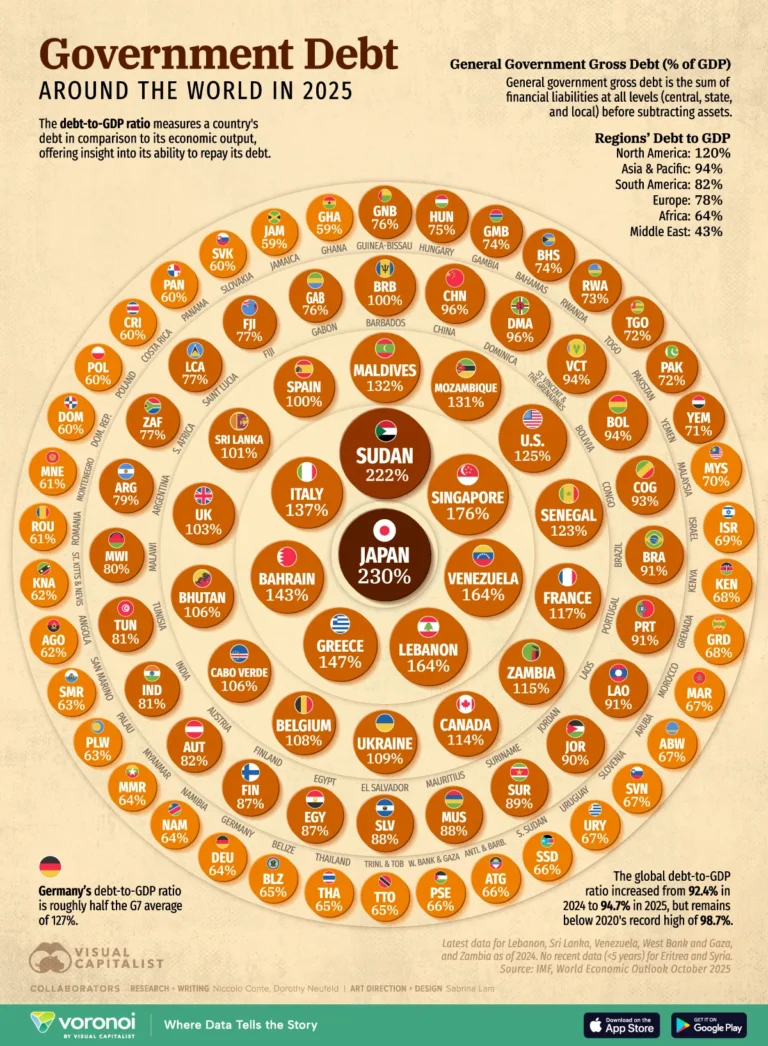

- World debt reached $111 trillion in 2025, equal to 94.7% of GDP.

- Japan, Sudan, and Singapore have the highest debt ratios globally, while the U.S. ranks in 11th with a 125% debt-to-GDP ratio.

World debt is so high that 23 countries are borrowing more than their GDP, including two countries owing more than double their annual economic output.

As debt-to-GDP ratios continue to swell, servicing them is getting more expensive. Strikingly, more than 3.4 billion people live in countries where net interest payments on public debt exceed education or health funding.

This graphic shows the countries with the highest debt-to-GDP ratios in 2025, based on data from the IMF’s latest World Economic Outlook.

World Debt Continues to Climb

Below, we rank countries by government debt as a share of GDP:

| Rank | Country | General Government Gross Debt (Percent of GDP) |

| 1 | 🇯🇵 Japan | 230% |

| 2 | 🇸🇩 Sudan | 222% |

| 3 | 🇸🇬 Singapore | 176% |

| 4 | 🇻🇪 Venezuela | 164% |

| 5 | 🇱🇧 Lebanon | 164% |

| 6 | 🇬🇷 Greece | 147% |

| 7 | 🇧🇭 Bahrain | 143% |

| 8 | 🇮🇹 Italy | 137% |

| 9 | 🇲🇻 Maldives | 132% |

| 10 | 🇲🇿 Mozambique | 131% |

| 11 | 🇺🇸 United States | 125% |

| 12 | 🇸🇳 Senegal | 123% |

| 13 | 🇫🇷 France | 117% |

| 14 | 🇿🇲 Zambia | 115% |

| 15 | 🇨🇦 Canada | 114% |

| 16 | 🇺🇦 Ukraine | 109% |

| 17 | 🇧🇪 Belgium | 108% |

| 18 | 🇨🇻 Cabo Verde | 106% |

| 19 | 🇧🇹 Bhutan | 106% |

| 20 | 🇬🇧 United Kingdom | 103% |

| 21 | 🇱🇰 Sri Lanka | 101% |

| 22 | 🇪🇸 Spain | 100% |

| 23 | 🇧🇧 Barbados | 100% |

| 24 | 🇨🇳 China | 96% |

| 25 | 🇩🇲 Dominica | 96% |

| 26 | 🇻🇨 Saint Vincent and the Grenadines | 94% |

| 27 | 🇧🇴 Bolivia | 94% |

| 28 | 🇨🇬 Republic of the Congo | 93% |

| 29 | 🇧🇷 Brazil | 91% |

| 30 | 🇵🇹 Portugal | 91% |

| 31 | 🇱🇦 Laos | 91% |

| 32 | 🇯🇴 Jordan | 90% |

| 33 | 🇸🇷 Suriname | 89% |

| 34 | 🇲🇺 Mauritius | 88% |

| 35 | 🇸🇻 El Salvador | 88% |

| 36 | 🇪🇬 Egypt | 87% |

| 37 | 🇫🇮 Finland | 87% |

| 38 | 🇦🇹 Austria | 82% |

| 39 | 🇮🇳 India | 81% |

| 40 | 🇹🇳 Tunisia | 81% |

| 41 | 🇲🇼 Malawi | 80% |

| 42 | 🇦🇷 Argentina | 79% |

| 43 | 🇿🇦 South Africa | 77% |

| 44 | 🇱🇨 Saint Lucia | 77% |

| 45 | 🇫🇯 Fiji | 77% |

| 46 | 🇬🇦 Gabon | 76% |

| 47 | 🇬🇼 Guinea-Bissau | 76% |

| 48 | 🇭🇺 Hungary | 75% |

| 49 | 🇬🇲 The Gambia | 74% |

| 50 | 🇧🇸 The Bahamas | 74% |

| 51 | 🇷🇼 Rwanda | 73% |

| 52 | 🇹🇬 Togo | 72% |

| 53 | 🇵🇰 Pakistan | 72% |

| 54 | 🇾🇪 Yemen | 71% |

| 55 | 🇲🇾 Malaysia | 70% |

| 56 | 🇰🇪 Kenya | 68% |

| 57 | 🇬🇩 Grenada | 68% |

| 58 | 🇲🇦 Morocco | 67% |

| 59 | 🇦🇼 Aruba | 67% |

| 60 | 🇸🇮 Slovenia | 67% |

| 61 | 🇺🇾 Uruguay | 67% |

| 62 | 🇸🇸 South Sudan | 66% |

| 63 | 🇦🇬 Antigua and Barbuda | 66% |

| 64 | 🇵🇸 West Bank and Gaza | 66% |

| 65 | 🇹🇹 Trinidad and Tobago | 65% |

| 66 | 🇹🇭 Thailand | 65% |

| 67 | 🇧🇿 Belize | 65% |

| 68 | 🇩🇪 Germany | 64% |

| 69 | 🇳🇦 Namibia | 64% |

| 70 | 🇲🇲 Myanmar | 64% |

| 71 | 🇵🇼 Palau | 63% |

| 72 | 🇸🇲 San Marino | 63% |

| 73 | 🇦🇴 Angola | 62% |

| 74 | 🇰🇳 Saint Kitts and Nevis | 62% |

| 75 | 🇷🇴 Romania | 61% |

| 76 | 🇲🇪 Montenegro | 61% |

| 77 | 🇩🇴 Dominican Republic | 60% |

| 78 | 🇵🇱 Poland | 60% |

| 79 | 🇨🇷 Costa Rica | 60% |

| 80 | 🇵🇦 Panama | 60% |

| 81 | 🇸🇰 Slovakia | 60% |

| 82 | 🇯🇲 Jamaica | 59% |

| 83 | 🇬🇭 Ghana | 59% |

Japan takes the lead with a 230% debt ratio, declining from 235% in the IMF’s April forecast.

Despite this, Japan’s new prime minister is planning to revive ‘Abenomics’ through easy monetary policy and billions in subsidies. While this likely does not bode well for its debt pile, Japanese equities surged to record highs after the election.

War-torn Sudan follows next, with a 222% debt to GDP, followed by Singapore, at 176%.

In Europe, Greece’s debt burden is highest overall, at 147%—nearly double the region’s average. Italy follows next, with a 137% debt ratio, falling from 2020 highs of 155%.

Overall, America ranks 11th globally. As it stands, the current federal budget is projected to add $1.8 trillion each year to the $38 trillion debt pile. While the U.S. debt ratio is 125% today, it will likely only continue to rise.

Story by Visualcapitalist